Penalty-Free Property Registration Deadline Announced

The General Department of Taxation has declared a grace period for owners of unregistered or outdated immovable properties, offering an exemption from administrative penalties, including surcharges and interest, provided they complete their registration or update their property information by the end of June 2024. This directive, issued in a press release on 25 April 2024, […]

Authorities Reject Free Land Giveaway Announced by Individual in Kampong Speu Due to…

The Oral District Administration in Kampong Speu province has officially refuted claims made by Mr. Chuon Kunthea regarding the distribution of land to individuals, citing that the designated land falls within the confines of the Oral Mountains Wildlife Sanctuary. This announcement was made on April 21, 2024, following Mr. Kunthea’s assertions of distributing land, as […]

Vietnam Revised Land Law Allowing Property Rights for Overseas Vietnamese to Boost Real Estate Market

The recently revised Land Law, which extends land use rights to overseas Vietnamese (OVs) and Vietnamese citizens living abroad, is anticipated to provide a significant impetus to the country’s real estate sector, according to Vietnamplus dated April 11, 2024. Lieu Nguyen, the global ambassador for Vietnam, Cambodia, and Indonesia at the US National Association of […]

Cambodia’s New Law Paves the Way for Inland Waterway Investment

The Cambodian government has taken a significant step towards enhancing inland waterway investment with the official promulgation of the Law on Inland Water Transport. Encompassing 18 chapters and 275 articles, this legislation aims to stimulate investment and development in Cambodia’s inland waterway and port sector, offering lucrative opportunities for both domestic and international trade. Signed […]

The gov’t Introduces Five Urgent Measures to Tackle Factory Challenges Amid Hot Weather

The Ministry of Labor and Vocational Training (MLVT) has rolled out five immediate measures aimed at addressing challenges faced by factories during hot weather conditions. This announcement was made on April 9, 2024. The measures prescribed by the Ministry include: Ensuring proper ventilation by opening doors and windows or installing fans within the workplace. Increasing […]

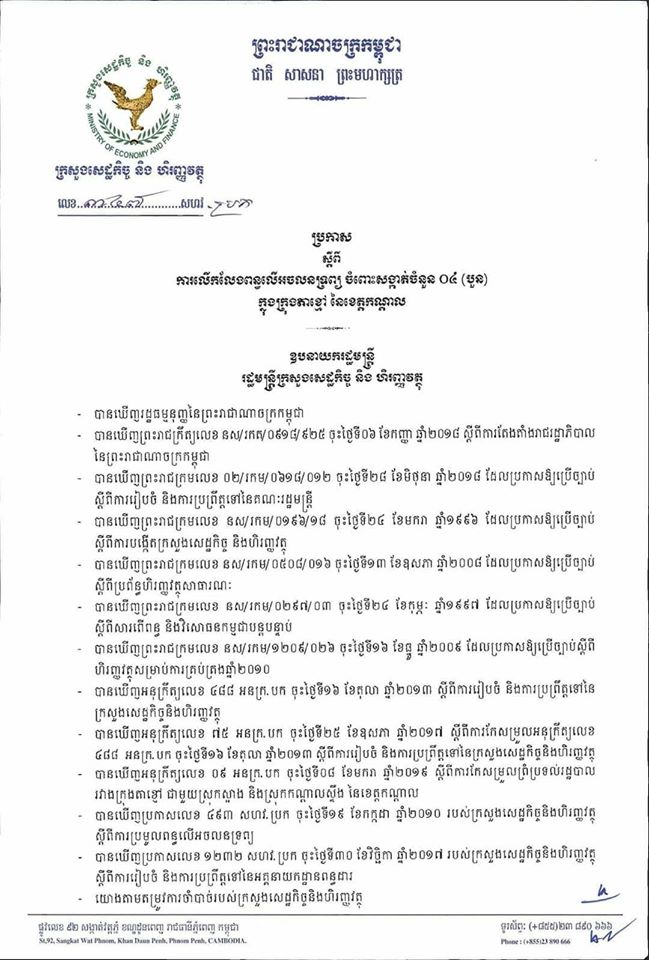

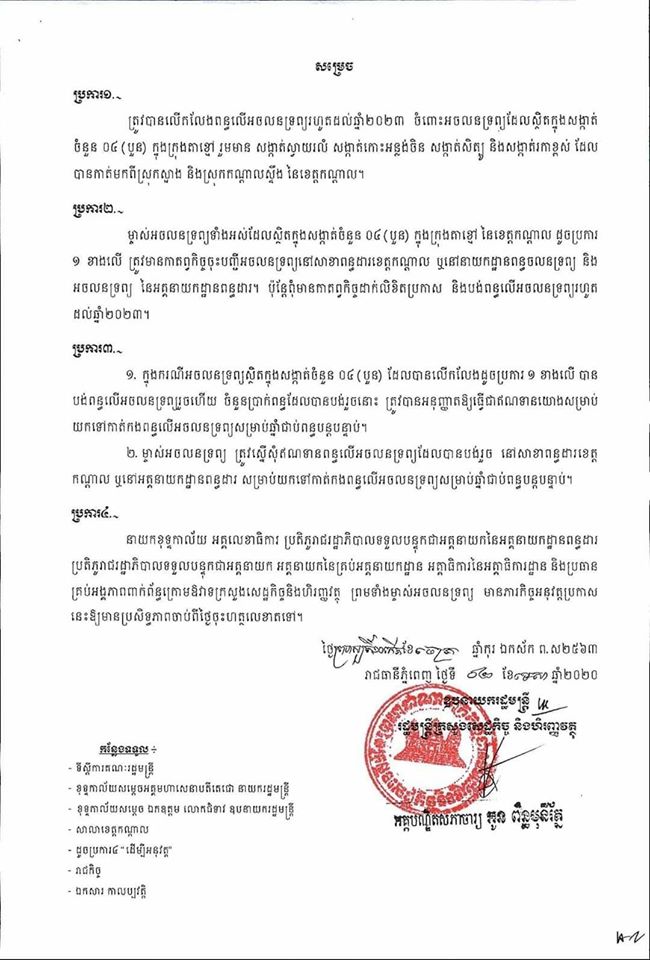

New Government Regulations Set Property Tax Procedures and Rates

The Ministry of Economy and Finance has announced new regulations governing the management of property tax collection in Cambodia, setting a fixed rate of 10% of total real estate rental fees. This proclamation, outlined in Prakas No. 169 MEF.PrK.PD dated March 20, 2024, aims to streamline property tax procedures and ensure fair taxation across the […]

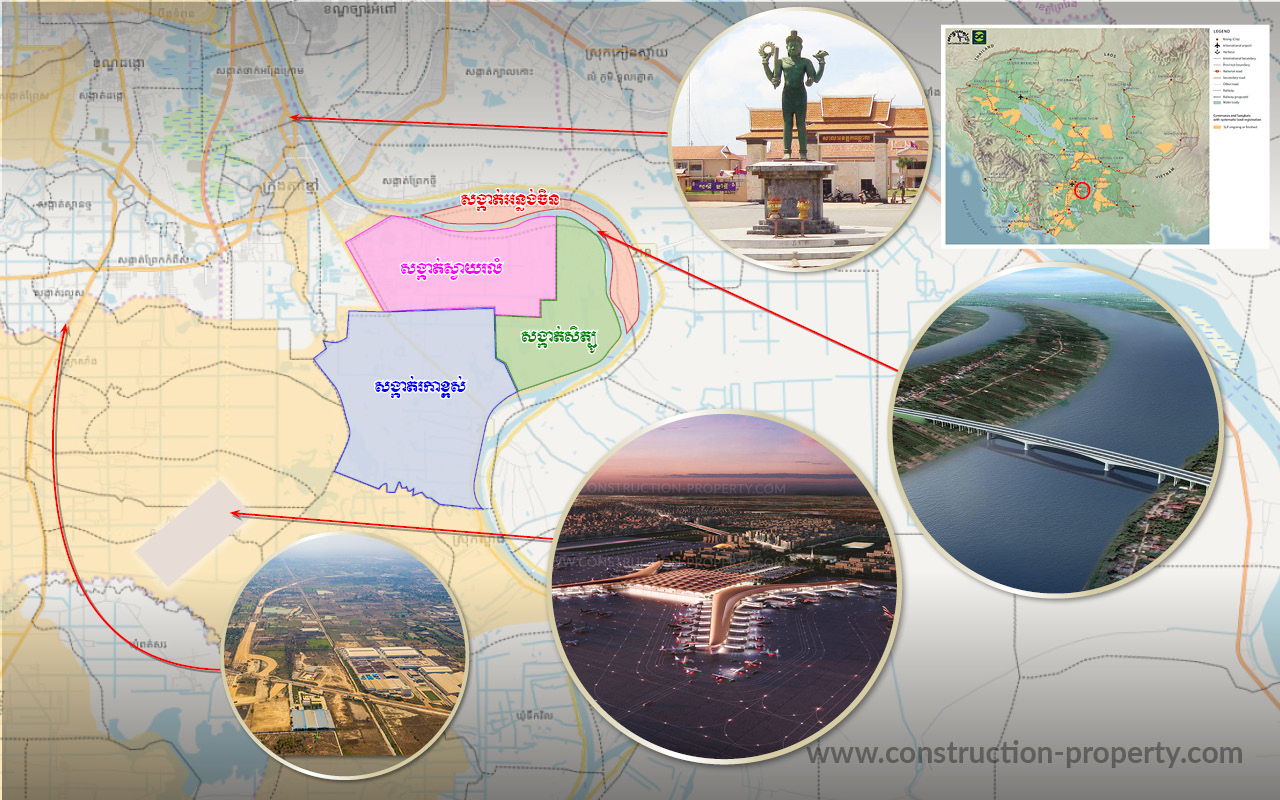

ខ្មែរ

ខ្មែរ